When looking for a financial adviser, besides making sure that your personality is compatible with theirs and you’re happy working together, making sure they’re attentive, and you like their values, you’ll also want to consider these three things: that they are independent, that they’re on the FCA (Financial Conduct Authority) register, that they have their fees listed on their website. These are things that we pride ourselves on at Plan With Neil. We are on the FCA register, we pride ourselves on our personal service, fast response times, our independence and integrity, and we are transparent about fees. Here’s a little bit about each of these important traits:

Independence

Did you know that there are two types of financial advisers: independent and restricted. Both types of financial advisers know what they’re talking about, but in the case of a restricted financial adviser they are limited to recommending products or services from certain providers or even one provider. Those products or services may be good, but are they the best for your unique circumstances? Maybe, maybe not.

When you go with an independent financial adviser (IFA), the world is your oyster and your IFA can look at all of the options across the market and help you choose which one is the absolute best for you. An IFA’s advice is going to be unbiased with no provider restrictions.

Regardless, a financial adviser must be transparent with you about whether they are independent or restricted.

Check that they are on the FCA Register

You certainly wouldn’t go to a back alley doctor, so don’t go to an unregistered financial adviser. Regulations are there for a reason and you don’t want to give out your information willy-nilly. You want to make sure that your financial adviser is qualified and has the right credentials too. If they’re on the register, you can rest assured that your financial adviser is capable.

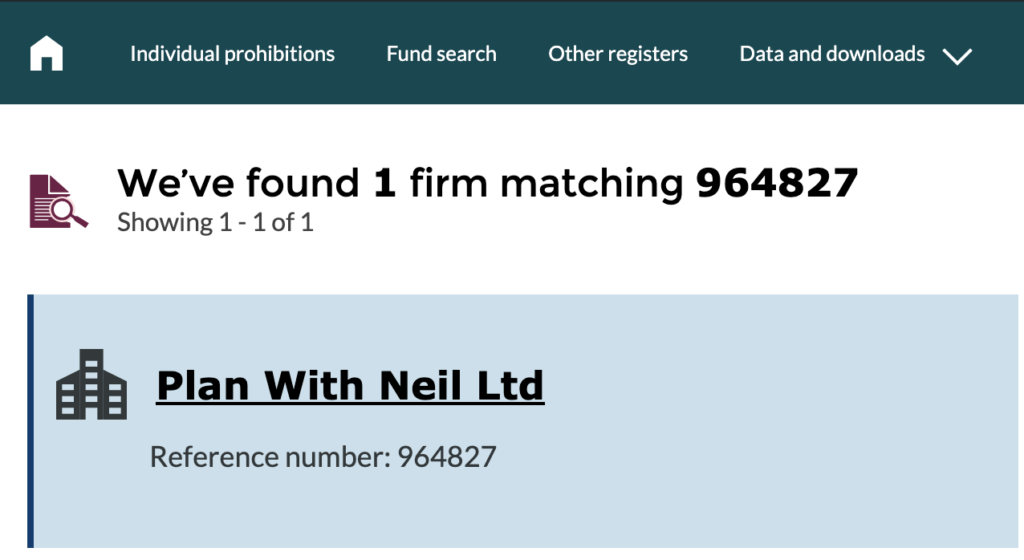

We have our FCA registration number at the bottom of the homepage and you can verify this on the FCA register.

Fees

There’s a lot of uncertainty when it comes to money and that can give people anxiety, especially when you don’t know what a financial adviser’s services cost. We want to make our clients and prospective clients feel at ease by listing our fees on our website and being transparent about the cost.

To quickly sum up the prices for our three main subscriptions:

- Financial Foundations costs £1188 for the first 12 months.

- Retirement Planners (formerly known as Your Financial Plan) costs £1800 for individuals and £2400 for couples for the first 12 months.

- Millionaires Club costs £3600 for the first 12 months.

After the first 12 months, you can cancel at any time. Why do we go with this subscription based model? Because unlike other financial advisers, we do not charge based on how much money you have or how much is in the pension pot. Instead, we charge based on the advice we give and our expertise. We keep your best interest in mind and encourage you to enjoy your money.

In Conclusion

Our mission at Plan With Neil is to help people live happier, more contented lives. If you’re looking to have more peace of mind when it comes to your finances, get in contact with Neil today.